AgTech has become the vehicle whereby the same amount of farmland that is in use now will provide sufficient food for the world’s growing population in future years. Furthermore, people are demanding higher quality food and environmental conservation from our farmers. These challenges are presenting opportunities with rich rewards for the problem solvers.

There is big money being poured into agricultural technology by investors and the industry giants. According to Ocean Park, an AgTech investment bank, there has been, in just the U.S. in the last three years, 467 AgTech capital raises totaling $6.0 billion of private capital, and last year saw 28 AgTech M&A transactions.

The large AgTech companies are swallowing up small, startup AgTech companies. Most of the M&A activity has involved private companies because there just aren’t very many small public AgTech companies available that have a proven solid business plan or a disruptive technology.

In this article, I will review four small public AgTech companies that I believe are investible on their own merit. The possibility of being an acquisition target is a bonus.

AgJunction

AgJunction [TSX: AJX] (OTCPK:AJXGF) works with agricultural OEM companies to develop customized automation modules for precision steering of off-road farm vehicles used for fertilization, planting, and seeding. The company has gone through restructuring last year, selling assets, consolidating into their headquarters in New Mexico, reducing headcount and replacing the previous CEO with the former COO who is implementing new strategies for ramping up revenue, including:

- Introducing new products such as three dimensional terrain mapping, multiple vehicle alignment which coordinates collection vehicles with harvesting vehicles, and added functionality to their automated steering product, Wheelman, allowing for portability for use in more than one vehicle and eTurns, a feature found on more expensive systems.

- Expanding into becoming a global company, AgJunction announced a new customer in Japan and plans to expand into the southern hemisphere in order to remove or reduce seasonality lumpiness from their earnings.

- Expanding their online presence by making their website more user friendly and adding service of its online store, Handsfreefarm.com for Canada.

- Developing an SaaS solution, Whirl Cloud, to provide vehicle control and advanced diagnostics. The company received its first purchase of the Wheelman product, combined with Whirl Cloud from its new Japanese customer earlier this year.

Source: AgJunction online store

A quick comparison of revenue over the last few years is misleading. The company experienced lower revenues in 2019 due to the ending of a bulk purchase order in the third quarter last year and because of termination of some products sold due to the sale of two divisions. But gross margins improved from 34.8% to 40.3% on a Y/Y basis in the second quarter this year, and the total revenue reported exceeds Y/Y revenue for the prior year minus the bulk purchase order by 31%.

| 2016 | 2017 | 2018 | 2019 | TTM |

| 42.3 | 46.8 | 64.5 | 39.2 | 21.7 |

Source: Seeking Alpha

The company cited a slowdown due to supply chain complications and OEM customers hesitation to invest in new technology at the onset of the COVID-19 pandemic but expects to recoup delayed sales.

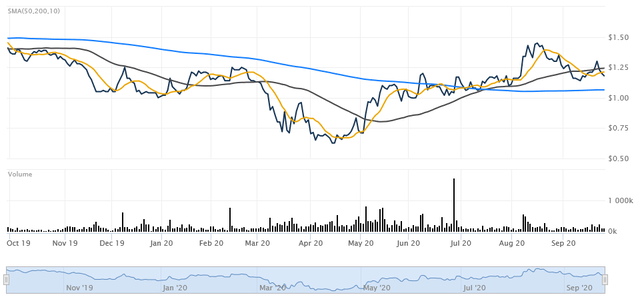

The chart is displaying a 50-day moving average crossing above the 200-day moving average, which is considered a basic positive development in technical analyses, the golden cross.

Source: Wall Street Journal Advanced Charting

AgJunction has over 200 patents and patents pending and defends those patents vigorously. The company has a lawsuit pending against Kubota claiming infringement of three patents. The lawsuit is expected to be settled out of court in the next few days or weeks which could result in a windfall for AgJunction.

A recent investor presentation indicates that there are 121.1 million shares with institutions owning 10% and insiders owning 15% of the shares. The market cap is $37.5 million. The company reported $14.5 million in cash as of the end of June. That translates to $0.12 a share. With a recent share price trading at $0.31, the market is valuing the company at $0.19/share plus cash. The EV is $23 million and, based on TTM revenue, is trading at a modest EV/S ratio of about 1X.

For the purpose of this article, all info on AgJunction is in U.S. currency.

Risks include that new products introduced do not achieve success and that the global expansion plan results in widening losses.

There’s a good reason for optimism as the company has slimmed down subsequent to selling divisions and restructuring, introducing new products, expanding its online presence and there could be a kicker in the patent infringement lawsuit.

Bee Vector Technology (OTCQB:BEVVF) [CSX:BEE]

BVT has been conducting agricultural crop research in partnerships with Universities overseen by government agencies such as the USDA for 20 years. The company was the first and only as of this date to be granted regulatory approval for bee vectoring by the EPA in August of last year to commercialize their crop technology, which includes a patented fungicide called CR-7, contained in tiny cannisters called Vectorides delivered by honeybees or bumblebees.

Vectorides are placed on hive floors and stick to the bees as they leave the hive and fall when the bees land on crop flowers. The process is repeated each time the bee brings back pollen to the hive. CR-7 is organic, biodegradable, and has no harmful effect on humans. The EPA registration validates BVT’s claims that CR-7 improves crop yields and reduces crop disease, while the bee delivery system results in reducing the amount of product needed to treat each plant. All of which saves growers money.

BVT has been able to penetrate blueberry growers that own over 80% of the U.S. blueberry acreage as it begins its second season. The company has also started strawberry pilot programs in Florida. Florida strawberry farms have been under great pressure unable to compete with Mexican and California growers. BVT is pending approval by Mexican and California authorities as well as pending approval in Canada, Switzerland and Morocco. Management plans to apply for European approval next year.

There are several future revenue streams that the company plans on establishing beyond the ongoing U.S. blueberry and strawberry farms. BVT will be pursuing pilot programs in additional crops such as almonds in California and cranberries in the New England states. The company plans to expand into a global footprint and partner with local companies to establish a sales team. BVT is also seeking licensing partners where it will blend third party approved organic fertilizers and growth supplements with its bee delivery system.

BVT is paid when it does its work during blooming season which occurs just once a year. As they just started commercialization, revenues are going to be lumpy on a quarterly basis with three quarters having zero revenue. As the company diversifies its crop and geographic footprint, the lumpiness should be reduced or eliminated. The lack of revenue since the second quarter is reflected in the stock chart not looking very positive at this time but should pick up as regulatory approvals are gained, new pilot programs established, and pilot programs expanded into full farm contracts.

Source: WSJ Advanced Charting

Insiders own about 13% of the shares. There are 92.1 million shares outstanding, 21.4 million warrants, and 12.2 million exercisable options for a fully diluted share count of 125.7 million as of June 30. At the recent share price of $0.20, the market cap is $25 million.

BVT is completing its first year of sales which will result in almost $300K for a loss of ($0.06) per share with gross margins of 40%. Management expects to triple revenue to about $1 million for the 2020-2021 season. With the wide range of expanding revenue streams, the outlook going forward calls for continued strong growth for years to come.

Applying the same growth rate of 3X for 2021-2022 results in revenue of $3 million. Margins should improve as the company scales. It is likely there will be a capital raise before reaching profitability as early as 2022. Diluting shares by 10%, applying a gross margin of 60% results in price to sales ratio of 10X and a gross profit of $1.7 million in just the third year of commercialization.

Working capital of $0.6 million and cash of about $0.8 million was reported as of the end of June. The company secured a $6 million line of credit in April, of which it has used only about $600K. The credit line is equity-based and not debt-based and is sufficient to fund operations for the next year. The company has no debt.

Marrone Bio Innovations (NASDAQ:MBII)

MBI describes themselves as the only public pure play biologicals company. Over the last few years, the company has teetered on the edge of bankruptcy while developing an extensive pipeline along with escalating revenues improving margins, making a transformative acquisition, adding new partnerships and expanding its global footprint.

The company’s flagship product has been Regalia, which is a family of fungicides used for enhancement of plant health. Regalia has enjoyed market share leadership and has recently been approved for the Canadian cannabis and hemp market. California cannabis and hemp approval is pending. The company has spent heavily on R&D to develop a strong pipeline and is now implementing its strategy designed for profitability.

MBI has a three-tier strategy:

- Short term – introduce new products.

- Intermediate term – introduce next generation products.

- Long term strategy – international expansion.

Recent new product developments include EPA approval for Pacesetter in February. Pacesetter improves plants’ root systems and is pending approval in individual states that are major wheat and soybean producers. Jet Oxide Sanitizer had been approved for usage beyond fruit and vegetables and has been effective in combating COVD-19 by eliminating the virus on food industry equipment and machinery. Stargus, a new fungicide for plant health has been approved by the EPA as well as gained approval for each U.S. state and territory, as well as Mexico and Canada.

MBI claims that combining chemical and biologics creates exponentially better solutions and is introducing a next generation crop protector by partnering with Vive Crop Protection to commercialize Azoxystrobin, a fungicide for wide use in crop protection which is made up of MBI’s biologic Regalia and Vive’s chemical solution.

The Pro Farm acquisition, a Finland-based company, expands MBI’s footprint into Europe as well as Latin America where Pro Farm has been active. The company currently has 73 active research projects in Latin America. Research studies are required in each jurisdiction in order to gain registration and approval for commercialization.

The stock price has been on a nice uptrend since hitting a COVID-19 inspired bottom in the spring.

Source: WSJ Advanced Charting

There are 152.5 million shares outstanding, and the market cap is $181.4 million. MBI reported $10.4 million in cash and $8.9 million in debt as of the end of the second quarter. The EV is $182.9 million. Consensus estimates are for revenue of $60.64 million for 2021, resulting in an EV/Sales ratio of 2.9X, indicating the stock is currently fairly priced in comparison to its peer group.

Management is counting on raising $20 million from warrant conversions with strike prices of $0.75 with expiration dates ranging from December 15, 2020, to December 15, 2021, which would be sufficient to carry them into 2022 when profitability is expected. I think that the stock will find new investor support should the possibility of profitability become clearer.

Risks include that the active ingredient in Regalia is sourced from one supplier located in China and Pro Farm products are partially sourced from Russia.

Where Food Comes From (OTCQB:WFCF)

WFCF began over 20 years ago as a source verification company for beef producers facing difficulty in exportation at the time of Mad Cow Decease. The company has expanded into providing certification and sourcing services for more than 40 standards such as non-GMO, gluten free and organic for 15,000 ranches, farms, restaurants and some of the world’s largest food companies such as Tyson Foods (NYSE:TSN) and Whole Foods Market.

WFCF is involved in every type of food business and is the market share leader in independent, third party food production certification and sourcing verification. Key drivers for WFCF services are consumers have an increased awareness of their diet choices and want assurance that they are buying what they think they are buying, and businesses need to verify their product claims in order to justify the pricing for higher quality products. Other factors are a growing awareness and concern for animal welfare and worker’s rights.

WFCF’s number one product is food labeling that informs consumers the source of the food as well as through QR codes which can be used to access information on a food product through the internet. The company has scaled organically and through 20 acquisitions which have allowed the company to offer bundled services such as non-GMO and organic, which increases sales as it lowers costs for the customer. The more recent acquisitions have added a range of sustainability and farm management services that are offered on an SaaS revenue model with royalty and software licenses.

WFCF also sells cow identification tags which are listed as products in the revenue section of their earnings reports.

| Six months ended June 30, | ||||||||

| (Amounts in thousands, except per share amounts) | 2020 | 2019 | ||||||

| Revenues: | ||||||||

| Verification and certification service revenue | $ | 5,911 | $ | 6,555 | ||||

| Product sales | 1,521 | 1,276 | ||||||

| Software license, maintenance and support services revenue | 380 | 595 | ||||||

| Software-related consulting service revenue | 516 | 417 | ||||||

| Total revenues | 8,328 | 8,843 | ||||||

Source: Second Quarter 10Q

Revenue decreased slightly for the first six months of this year compared to last because the company was unable to complete some onsite inspections due to COVID-19 restrictions and because many customers reduced spending due to the economic uncertainties. The company has been steadily building revenue and gross profits until the pandemic hit, but this should be a short-term hitch. The pandemic has increased demand for organic food as well as reliable sourcing information, and we are likely to see WFCF continue on its growth course in the near future and coming years.

| 2015 | 2016 | 2017 | 2018 | 2019 | TTM | |

| Revenue | 10.3 | 11.6 | 15.4 | 17.4 | 20.8 | 20.3 |

| Gross Profit | 4.9 | 5.4 | 6.8 | 7.7 | 9.1 | 9.0 |

Source: Seeking Alpha

Similar to the majority of stocks, WFCF sold off at the advent of the pandemic, but this stock has taken a longer time to bottom out and recover. A new uptrend began in August, and the stock price has climbed above the 200-day moving average where it will probably linger until investors restore their confidence with the next quarterly report with the likely scenario that the growth in revenue and gross profits has resumed.

Source: Wall Street Journal Advanced Charting

Insiders own about 14.4 million of the almost 25 million shares. The market cap is $47 million. Reported cash was $4.8 million as of June 30th with working capital of $3.5 million and debt of $4.7 million. The EV is $47 million. Estimating revenues of $23 million for 2021 results in an EV/S ratio of 2X, which is very modest for a profitable company growing at a steady 15% clip with gross margins consistently above 40% and positive ROE of 8.45% and ROA of 5.14%.

Conclusion

In this study, I only included small cap AgTech companies that have a visible path to profitability or are already profitable. I found that the stocks that fit that bill are rare, and that makes them all the more investible. The four stocks offer potential acquisition at a premium to market share price due to the M&A activity in the sector as well as different attributes for investment consideration. AgJunction is undervalued and has the potential for a rich payday if it is able to successfully settle its patent infringement lawsuit. Bee Vectors has many pending approvals, potential partnerships, expansion into other crops and territories as it commercializes its technology. Marrone Bio has an abundance of products on its pipeline and profitability in its vision, Where Food Comes From has been a solid performer who has experienced a short-term disturbance.

Disclosure: I am/we are long BEVVF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

More Stories

U.S. charges FTX founder Sam Bankman-Fried with criminal fraud

Time series forecasting with XGBoost and InfluxDB

Full-stack engineering is one-third as good