The large photo: In scenario you weren’t paying out focus, Apple is now a financial institution. I jest, but only a small. It begun with the Apple Card, and now the tech large wishes to maintain your funds, as well. Of course, it is absolutely optional, but it does have some rewards if you are now an Apple cardholder.

As of May well 2021, there were being 6.4 million Apple Card consumers. Backed by Goldman Sachs, the overall service is preferred for its convenient features, like Apple Shell out and wallet app integration, real-time balances, on-product account management, hard cash back again, and protected card/CVV numbers.

Apple Card has been prosperous ample that Cupertino now wants to keep your financial savings. On Thursday, the business announced it would shortly offer “superior-produce” discounts to Apple Cardholders.

“Apple declared a new Cost savings account for Apple Card that will allow buyers to help you save their Daily Cash and mature their benefits in a high-produce Financial savings account from Goldman Sachs,” Cupertino mentioned.

Here is how it is effective. Apple Card is now set up to give consumers three per cent again on Apple buys (in-retailer or digital) and two p.c for transactions with participating vendors like Walgreens, ExxonMobil, T-Mobile, and other individuals. All other expenses get a one particular-per cent return.

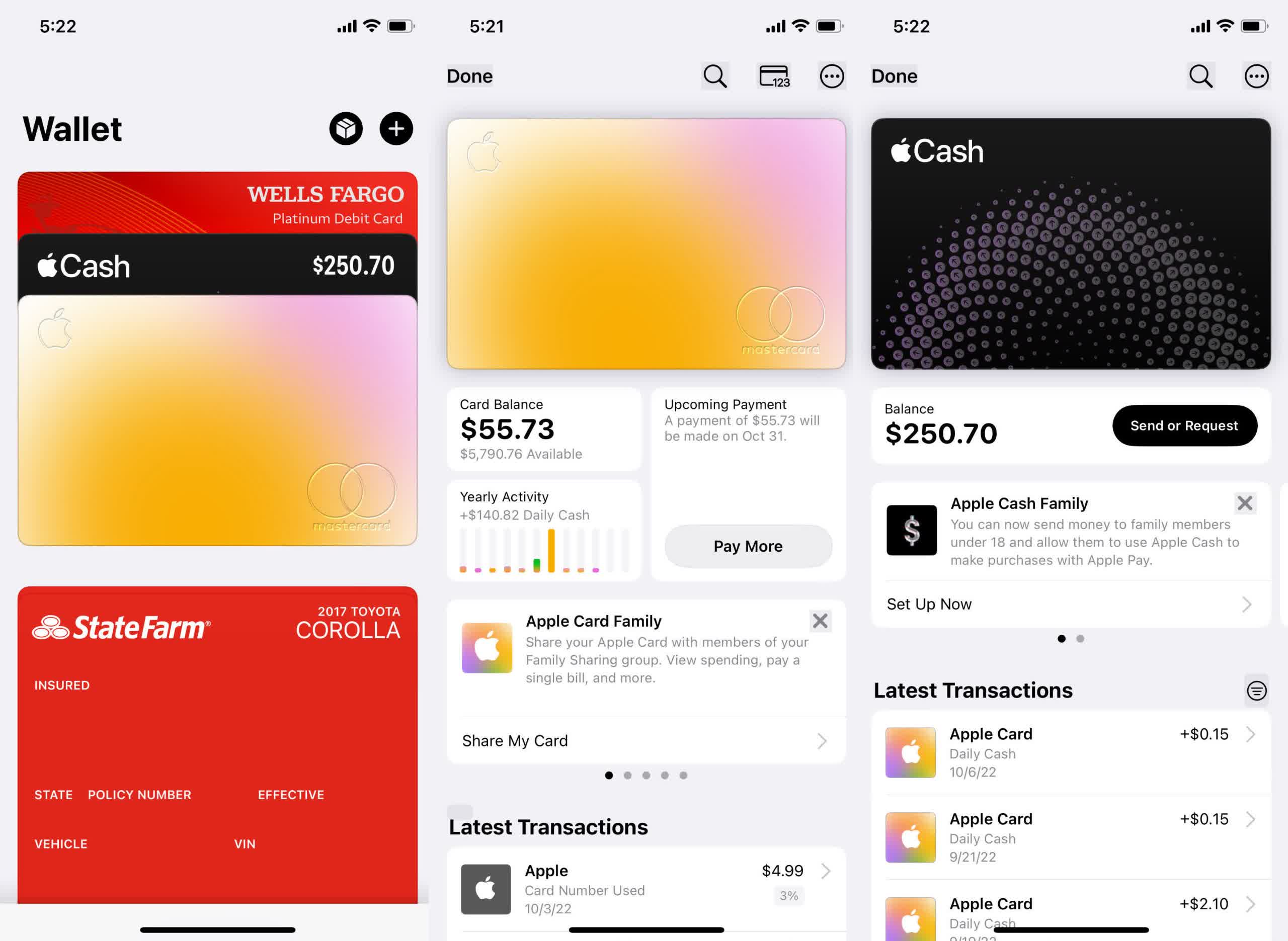

At the moment, this cash is saved on a individual digital card in Iphone owners’ wallets termed “Apple Money.” It acts like a pre-compensated debit card drawing in opposition to the Apple Income harmony. Customers can also transfer funds to their typical financial institution account. In other words, the revenue sits there until eventually they do anything with it.

Apple is proposing to set that funds into a higher-yield Goldman Sachs savings so that it can receive even much more. When consumers established up an account, Every day Income will automatically start depositing into the discounts as a substitute of Apple Income. Nonetheless, customers can nevertheless decide to have the cash go into the virtual card if they like.

“Consumers can adjust their Every day Funds destination at any time,” the push launch reported.

Apple did not define “significant produce,” but something is better than absolutely nothing, which is what most banking companies give patrons on personal savings accounts. The function may possibly be one more enticing perk for Apple Card buyers if it’s really substantial-generate, specifically thinking of the handful of banking companies that however present interest-baring accounts ordinarily give noticeably fewer than one particular %.

Like all cards saved in the Wallet application, the cost savings account will have a administration display with similar alternatives like viewing benefits and other actions. Users can also transfer money to and from their connected checking accounts (utilised for making Apple Card payments), generating it like a normal money deposit account, just with out the brick-and-mortar lender.

Escalating the progress opportunity of Everyday Funds is a pleasant little incentive to set apart a minor “cost-free money,” primarily for all those that rarely contact it in any case. It could come in useful for unexpected expenditures or occasional splurging. If it certainly is substantial-produce, it might even be a much better possibility than users’ existing price savings accounts. Regardless, it can be tough to imagine latest cardholders stating “no thanks” to extra revenue, no matter of the yield.

More Stories

Powering Business Resilience: How Expert Technical Support Transforms Modern Enterprises

The Challenges of Modern Data Ecosystems Most Startups Don’t Envisage

Level Up Instantly: The Fastest Way to Buy Free Fire Diamonds in 2025