Decentralised exchanges (DEX) have risen as a strong alternative to traditional crypto networks. DEXs are one of the primary building blocks of the decentralised finance (DeFi) ecosystem. These protocols allow users to swap tokens directly with other users. We will explore some of the best dex coins to buy for high profits in April in this article.

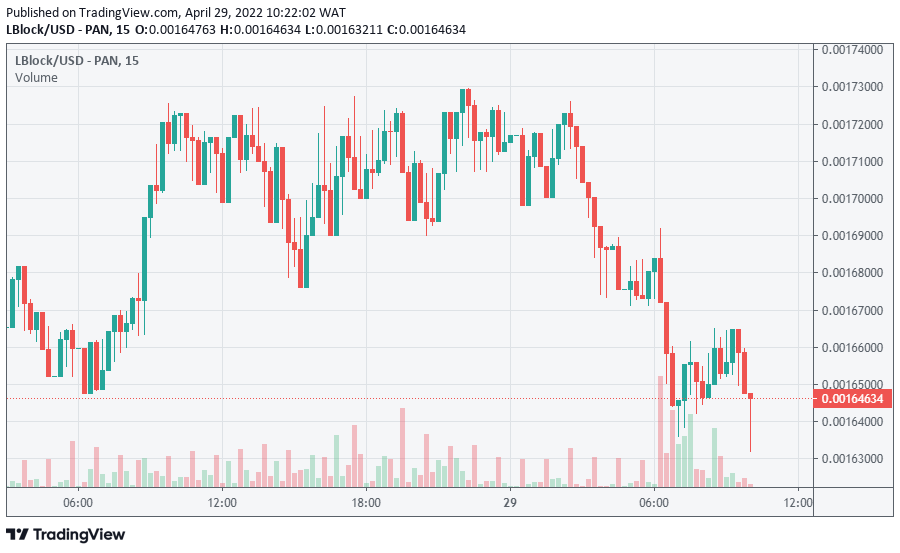

1. LuckyBlock (LBLOCK)

LuckyBlock is a game-centric crypto protocol established on the Binance smart chain (BSC) network. It is considered the fastest-growing gaming platform and our top pick on the best dex coins to buy for high profits.

The protocol has recorded outstanding performances since its launch. LuckyBlock was created to improve fairness and transparency in gaming processes.

Entrants nationwide can gain access to LuckyBlock. The protocol is known for its low margin operations, faster prize payout, full tracking and recordings, and increased security and transparency.

LuckyBlock uses Distributed Ledger Technology (DLT) to improve transparency and safety. DLT helps prevent projects from cyberattacks in the absence of a centralised store of data.

Lucky Block’s Platinum Rollers Club NFT collection has announced the commencement of its giveaway draws. According to the report, the first giveaway price will be 1 million worth of LBLOCK.

The protocol also hit its 50,000 token holder mark earlier this month. The remarkable performance of Lucky Block makes it one of the best dex coins to buy for high profits.

At press time, Luckyblock’s price is $0.0016. LBLOCK is down 2.36% in the last 24 hours.

2. Uniswap (UNI)

Uniswap is an Ethereum-based DEX and a protocol for automated token exchange. Its token is one of the best dex coins to buy for high profits.

The protocol aims to solve liquidity issues, one of the major problems in DEXs. Its simple, smart contract interface allows users to swap ERC-20 tokens.

Uniswap also uses a formalised model for pooling liquidity reserves. The protocol is committed to delivering free and decentralised asset exchange. Users can swap tokens, thereby creating liquidity. Hence, Uniswap does not need to rely on buyers and sellers.

The protocol has gained widespread prominence with an average daily trading volume of $152 million. Also, Uniswap has over 5,500 tokens available for its users to trade across its regular and Pro exchange.

Recently, UniSwap announced the launch of the Swap Widget. The widget allows developers to embed Uniswap swapping functionality easily. Furthermore, the widget includes several opportunities, including wrap assets, seamless swap of tokens, and being a part of a community or decentralised autonomous organisation (DAO).

At press time, UNI is $8.09. Uniswap has been down 2.95% in the last 24 hours.

3. PancakeSwap (CAKE)

PancakeSwap is an automated market maker (AMM) launched as a DEX for swapping BEP20 tokens on the BSC network. It is also one of the best dex coins to buy for high profits.

The platform allows users to exchange tokens by simultaneously granting liquidity through farming and fee earning. Users place their funds into the pool and earn liquidity provider (LP) tokens. Then, these tokens can be used to reclaim a share of the pool and a fraction of the trading fees.

A group of anonymous developers regulate PancakeSwap. However, users are given the power to control the platform by voting using the CAKE governance token.

PancakeSwap recently announced the launch of its liquidity features and a promotional event with $100,000 USDT prizes. The platform aims to add more DeFi features to create an avenue to educate its Binance users about the DEFI experience. Users can now add liquidity and create Liquidity Pool (LP) tokens through its liquidity features mini program.

At press time, PancakeSwap is $7.87. CAKE has been down 3.45% in the last 24 hours.

4. Curve Finance (CRV)

Curve Finance is a DEX platform created to swap between stable coins and exchange different tokenised versions of stablecoins. The platform’s market performance makes it one of the best dex coins to buy for high profits. At press time, Curve DAO’s price is $2.34. CRV is down 6.95% in the last 24 hours.

The platform functions as a decentralised liquidity aggregator. Users can add crypto assets to different liquidity pools and earn fees afterwards. Curve Finance has several Curve pools where users can swap between stablecoins and assets. A few popular stablecoins on offer are USDT, USDC, BUSD, DAI, and TUSD.

Curve grew rapidly after its launch by securing the underdeveloped stablecoin market. The platform is a great place to exchange stable coins due to its low fees and low spillage

Recently, Curve introduced its Layer 2 protocol known as cCRV. As a layer 2 swap on Curve, it will use the CRV emissions generated to incentivise the CurveV2 pool proxy contract. Also, a portion of its fees will be returned to Curve, and all liquidity will be kept on Curve.

5. 1Inch (1INCH)

1inch is one of the prominent DEX aggregators that delivers the best rates. To ensure this delivery, the network seeks the most profitable swapping routes across all leading DEXes. Its remarkable features make it one of the best dex coins to buy for high profits.

The network supports thousands of tokens. It searches across over 50 liquidity sources on Ethereum, over 20 on Binance Smart Chain, and over 8 on the Polygon network to get the most suitable transactions for its users.

1inch runs on the Ethereum and BSC networks. This allows diversification in a user’s trading options. The network unifies decentralised protocols whose synergy promotes the quickest, most lucrative, and protected operations in the DeFi ecosystem. Also, 1icnh is a next-generation automated market maker (AMM).

The network protects its users from front-running attacks and delivers attractive opportunities to liquidity providers. Recently, the network disclosed that it had expanded its DeFi space to the Fantom blockchain. The 1inch Aggregation and 1inch Limit Order Protocols have been deployed on Fantom. As a result, users can now enjoy more efficiency, flexibility, and access to deeper liquidity.

At press time, the digital asset’s price is $1.28. 1inch is down 4.52% in the last 24 hours.

More Stories

Powering Business Resilience: How Expert Technical Support Transforms Modern Enterprises

The Challenges of Modern Data Ecosystems Most Startups Don’t Envisage

Level Up Instantly: The Fastest Way to Buy Free Fire Diamonds in 2025